1095-A Form for Health Insurance Marketplace Statement 2024-2025

Show details

Hide details

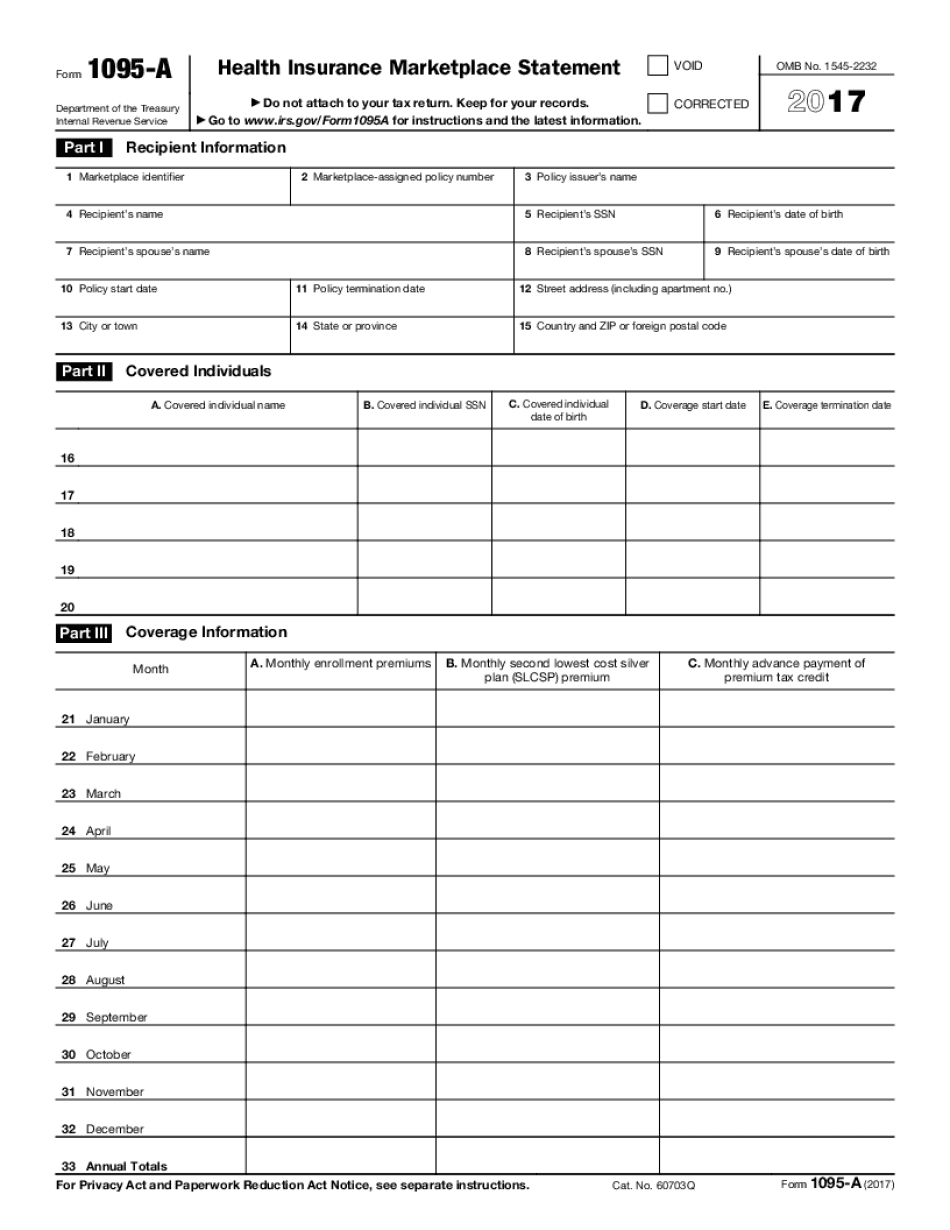

Information in Part III that is applicable solely to the individuals listed on your Form 1095-A and separately issued Forms 1095-A will include individuals not in your tax family. CAUTION NOT FOR FILING Form 1095-A is provided here for informational purposes only. Health Insurance Marketplaces use Form 1095-A to report information on enrollments in a qualified health plan in the individual market through the Marketplace. Don t use the information on the original Form 1095-A you received for ...

4.5 satisfied · 46 votes

form-1095a.com is not affiliated with IRS

Filling out Form 1095-A online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A full guideline on how to Form 1095-A

Every citizen must declare their finances on time during tax period, providing information the Internal Revenue Service requires as precisely as possible. If you need to Form 1095-A, our reliable and straightforward service is here to help.

Follow the instructions below to Form 1095-A promptly and accurately:

- 01Upload our up-to-date template to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Check out the IRSs official guidelines (if available) for your form fill-out and precisely provide all information requested in their appropriate fields.

- 03Fill out your document utilizing the Text option and our editors navigation to be certain youve filled in all the blanks.

- 04Mark the boxes in dropdowns using the Check, Cross, or Circle tools from the tool pane above.

- 05Use the Highlight option to accentuate particular details and Erase if something is not applicable any longer.

- 06Click the page arrangements key on the left to rotate or remove unwanted file sheets.

- 07Verify your forms content with the appropriate personal and financial paperwork to make sure youve provided all details correctly.

- 08Click on the Sign tool and generate your legally-binding electronic signature by adding its image, drawing it, or typing your full name, then add the current date in its field, and click Done.

- 09Click Submit to IRS to e-file your tax statement from our editor or select Mail by USPS to request postal document delivery.

Choose the simplest way to Form 1095-A and report on your taxes online. Give it a try now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

What Is 1095 A Form?

Find out information about your health care coverage from a 1095-A form online. Learn what other papers to prepare to get your Health Insurance Marketplace Statement on time.

A 1095 Form includes data regarding the effective date of the coverage, premium amounts, subsidy and so on. The document has several versions depending on the organization responsible for your insurance. There are A, B and C types.

The Internal Revenue Services collects necessary information and determines whether you have to pay the individual shared provision or not.

In case you opted health insurance through Marketplaces, you will receive a Form 1095-A. This document provides information about your insurance policy, your premiums and your relatives covered by the policy.

To organize data correctly and at the same time quickly, you may use online forms. These means are extremely helpful for everybody seeking a convenient way to deal with documentation. Fill out the template, sign it electronically and send to the recipient.

Your insurance company provides you with the 1095-A blank. It may be sent by email, fax or even sms. The document has to include:

- 01Your name.

- 02The amount of coverage.

- 03Tax credits you were entitled to.

- 04If you used them to pay for the insurance and the amount you spent.

Review all the details provided. These records may be used by you to complete your income tax filing, claim premium credits etc.

The Internal Revenue Service gets the second copy of the 1095-A Form.

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form 1095-A?

Form 1095-A may be used by a company to document tax payments made to the IRS by another company or a trust, and is an item from which the company would like to get a refund. The amount claimed for you will be your credit for income tax withheld in compliance with the tax laws. A Form 1095-A is the form the company must use to report the credits claimed by other companies and trusts on your return. Each form should have a section titled “IRS Credit”.

1095-A Schedule A, “Other Corporation (Partnership or S-Corporation)”

(Individuals) The Form 1095-A you will receive will show whether the other company has paid you income taxes. This section may include income tax payments that were made but have not been returned to you. You can choose to claim these payments as tax payments. They need to be included on your return.

(Partnerships) You may receive a different Form 1095-A, but it is probably the one you will receive if you were a partner or stockholder in the partnership. The partnership tax return you receive is usually not as detailed as the Form 1095-A we give you, but it may list all tax payments made through your partnership and also all tax due on your return.

(Trusts) The Schedule A will be the same form the IRS sent you, but it will have a title like the following:

A “Bonding Statement on Form 1098-A” with “Other Partnership, Corporation, or Trust” and the name of each individual who has claimed a tax credit or refund. You must sign this section, and we will mail you one by registered mail. You can choose to claim this tax credit by using Form 1098-EZ, “Qualified 1098-A Trust Instrument Return” or Form 1099-Q, “Qualified 1098-EZ Document Return”.

If you choose to claim a tax credit on your return, you should file Form 1040-EZ, “Received an Order or Letter from IRS.” You must attach Form 5043 to that return.

1095-D (Individuals only) The Schedule A give you will have a section titled “Other Corporation (Partnership or S-Corporation),” with a line item titled “Other Corporation (Partnership or S-Corporation).

Who should complete Form 1095-A?

You should complete this form if you:

Have reported to the Internal Revenue Service a self-employment loss

Have filed or are preparing to file income tax returns for any tax year ending December 31, 2013, 2014, or 2015

Are planning to take an active role in a business

Are a dependent of a nonresident alien who was present in the U.S. for 183 days or more during the year for an employer or affiliate, a foreign person if that individual was present in the U.S. for at least 183 days during the taxable year(s) of the nonresident alien

Are an S corporation or LLC that is paying dividends to a partner or member

Have received a letter from the IRS requiring you to provide information in connection with your own returns or the return of any other individual, including a nonresident alien who was present in the U.S. for 183 days or more. To avoid a penalty, you can provide your complete tax identification number on Form 8829. You can use the IRS e-file application for this form to electronically submit Form 1095-A. For more information on this process, see the Instructions for Form 1095-A, e-file or print the IRS e-file application or go to IRS.gov/e-file, or.

Have filed a joint return or had an estate of the deceased individual who received the Form 1095-A included in the estate, provided that no other individual is a taxpayer or a qualifying person (including an individual with respect to whom you file a joint return). You must attach the completed and signed Form 8829, or any amended tax return, to the joint return.

Other Important Information

If you used Form 8889 at a social security office in 2015, you can apply online using your social security account number and SSN from the information provided on the Form 8889. You can either:

Use this online application if you never mailed the Form 8889 in 2014, and you filed Form 2555 in 2015 instead.

Use the paper form to apply if you never mailed this form in 2014, but you filed Form 2555 in 2014 instead, and it is an amended return that included Forms 8889.

See Tax on Social Security Benefits (Publication 587) for information on applying for the social security benefit on a tax return.

When do I need to complete Form 1095-A?

You need to complete Form 1095-A: Annual Summary by April 15 each year. You can find an example of a complete Form 1095-A.

I forgot to use Schedule C (Form 1040) to calculate my self-employment taxes, or I missed a step on my Schedule C. What can I do?

You cannot make any changes after your self-employment tax return is filed—even as you complete the next step of our process. If you are filing any tax returns, complete Form 1040NR, Annual Return for Individuals. You cannot correct your omission until you have filed all the income tax returns for the year covered by that information return and this is the last year you will need to file income tax returns.

Can I create my own Form 1095-A?

Only the individual or entity to which your Form 1095-A is sent, or a related entity, can apply for a Form 1095-A to obtain information about a covered entity or entity section 1001 reporting its income from specified sources.

However, you may be able to obtain more timely information from other sources.

Note: To apply for the Schedule D Form 1095-A, you must provide the relevant information to the IRS. If you have questions about how to create the requested form with the IRS, call, or visit IRS.gov to obtain the form, available at, in English, Spanish, or French.

Can I provide you with the Form 1095-A I received from a foreign country or foreign entity?

The Form 1095-A you received from your foreign source is a foreign tax credit that may affect your federal tax liability. The Form 1095-A also may be available to you from the IRS in English, Spanish, or French.

It's best to obtain this information before you report your foreign income. To get this information, you must follow the instructions for Form 4684, Information for Alien Income Tax Treaty Beneficiaries, or the instructions for Foreign Bank and Financial Information Reporting obtaining Credit Information. You may need this information to determine the tax or penalty you may owe. You may also need this information if you plan to report foreign income in a taxable year that includes a U.S. reconciliation.

For more information regarding the Form 1095-A and the Form 4684, visit the instructions for Foreign Bank and Financial Information Reporting obtaining Credit Information.

You received a Form 1095-A from an individual resident in a foreign country and your nonresidential real property (such as a house or farm), as well as your nonresidential personal property (such as artwork), and your income earned in the United States, are owned directly or indirectly by that individual. Do not report the Form 1095-A on your U.S. income tax return.

What if you received the Form 1095-A from an alien?

To report information that is on a Form 1095-A, it generally must be received by an individual resident in a foreign country.

What should I do with Form 1095-A when it’s complete?

You must return the form to the IRS. To prepare Form 1095-A, you need to obtain a copy of the return that was originally filed.

How can I correct or update an information shown on Form 1095-B that I received electronically?

If you received Form 1095-B electronically, follow the instructions in its instructions to correct or update the information at the appropriate location. You might need the correct date or type of return to do so.

If you received Form 1095-B by mail, you must check with the service where you received it to ensure the appropriate documentation requirements are met. If the service indicated that it did not require documents to be filed electronically, you might need to use Form 4506. Do not submit incomplete or illegible Forms 1095-B to the IRS.

I got a Form 1095-B, but the information on it is incorrect. What should I do?

If you received Form 1095-B electronically, you need to check with the service where you received it to ensure the proper information and the correct filing date is entered.

If you received a Form 1095-B by mail, you need to check with the service where you received the return to ensure the appropriate documentation requirements are met. If the service indicated that it did not require documents to be filed electronically, you might need to use Form 4506. Do not submit incomplete or illegible Forms 1095-B to the IRS.

I received a Form 1095-E, which is a payment receipt for taxes or fees withheld from certain wages from employees covered under certain federal, state, or local government programs. Does the receipt need to be signed by me?

Yes. The receipt must show the payer's name and Social Security number, and the amount of the payment, if it was withheld in accordance with statute or regulation. It cannot show a payee's name, Social Security number, or taxpayer identification number or name of a person authorized to pay federal taxes.

Can I use Form 1045-E, Supplemental Quarterly Statement for Individuals Not Represented by Representation, to apply for an extension of time to file a claim for a refund?

No. Form 1045-E is a substitute form for a Form 1040-X, U.S. Individual Income Tax Return for Certain Federal Tax Offices, that must be filed separately.

How do I get my Form 1095-A?

Form 1095-A must be filed with the Internal Revenue Service each year, although it is not generally necessary to mail it to the IRS. However, if there is an outstanding tax liability, including penalties, withheld taxes and interest, and there is no current mayor on the income tax return, you may want to mail Form 1095-A to the Internal Revenue Service.

Can I report Form 1095-A on a tax return?

Yes. See IR-2010-13, How to Report Form 1095-A and the Form 1095-B, for details on reporting income and tax liability.

How do I report Form 1095-B?

If you have a Form 1095-B, you will file the form with the IRS. You will receive it in the mail in the same way as you received Form 1095-A. (Please note that we recommend that you include Form 1095-B on your tax return if you received more than one Form 1095-A.)

Do I need a tax return if the employee is receiving pay through a regular payroll deduction rather than the employment of your employees?

No. Under the Payroll Deductions Exemption, the employer does not have to withhold income tax from payment to the employee, so Form 3049 (Individual Business Income Tax Return) or TIN-3049 (Form 1099-MISC), or a similar document, is sufficient. (See IRM 25.1.5.5.3, Payroll Deductions Exemption for Form 1095-B; and IRM 25.1.5.6.1, Employer Tax Return (Form 1099).) You can send Form 3049, 1099-MISC or another similar document to the employee's address listed on his or her federal tax return.

Do you have information on payee(s) for Form 1095-B and 1099-MISC?

We have information on payee(s) for Form 1095-B and Form 1099-MISC. We are posting the information online so that individual taxpayers can access the information. You can search for or obtain the information for more than one payee by typing “1099-MISC” and the payee name or other information into the search field located at the top of the webpage.

What documents do I need to attach to my Form 1095-A?

Do not attach copies of paper records. Instead, list all the documentation and supporting documents you have. Examples of documents that you can list in the completed Form 1095-A are the complete list of your business, nonfranchise and partnership income and expenses, your federal and/or state tax returns, bank statements, pay stubs, insurance claim forms, and any other information that is required and helpful to your tax preparer.

Can I use this Form 1095-A if I received a federal income tax return and claim credit or refund?

Yes. If you received a federal income tax return by February 3, 2017, you may use this Form 1095-A to issue a credit to your Form 1040 by January 3, 2017. This allows you to include an amount for the period you received the Form 1040. Do not use this Form and list the amounts received for any period before February 3, 2017. If you received a Form 1040 before February 3, 2017, that you do not want to claim a refund from, attach a copy of it.

Where else might I use this Form 1095-A if I received a federal income tax return and claim credit or refund?

You have other options available in case you did not receive a federal income tax return.

If you did not file an American Indians and Alaska Natives (DIANA) Tax Return in 2016, you can use this Form 1095-A to issue a credit to a Form 1040, American Samoa Individual Income Tax Return. Do not use this Form if you have not filed an DIANA Return.

You can use this Form 1095-A to issue a credit for tax paid in Puerto Rico to be included in your Form 1040 as compensation paid as a resident of Puerto Rico, even if you did not file a U.S. citizen tax return; or,

For additional information on the Form 1095-A, visit the IRS website at.

When is the return due?

The credit is calculated based on:

The due date of your federal income tax return, listed on the form.

, listed on the form. The total amount of wages paid from wages reported on Form 1040, American Samoa Individual Income Tax Return, including all amounts of wages paid between August 8, 2016, through February 3, 2017.

What are the different types of Form 1095-A?

Form 1095-A is a one-page form that summarizes the information that an employer needs to file with your business. Form 1095-A is a free form you can get from most employers you hire keeping track of payroll and taxes. The information in the form is what is needed to calculate, file, and pay income taxes and employee withholding.

Some employers use Form 1095-A to send additional or different forms if needed, but usually it just summarizes and provides the information needed for you to file a timely 1099.

Below is a list of the information that would be recorded on Form 1095-A. The information will be the same at the same address but will be recorded differently due to the type of business.

Date of employment (or date your business begins as required by 35 USC Section 7424)

Employer name and address

Payment address and tax return

Date of business activities

Tax identification number including the year the business was established

Job titles

Severance pay

Sick or disability leave

Other leave

Employer information

Number of employees, including the number of hours worked

Amount of the salary, overtime, commissions, bonuses, or other pay provided

Income from any source and date

Amounts of wages paid directly to the employee, such as cash, check (or money orders) to be kept in the business check box, money orders written at the business, or money orders sent directly to the business

Total wages and commissions (including employer and employee tips);

Pension and benefits; and

Employee information

Employer name (business name and address), and

DOB (Dates of birth of the business owner and employees);

Business location;

Name and address of employer's bank; and

Type of business, such as sole proprietorship, partnership, corporation, etc.

If the business owner was a sole proprietor, the following information should be included for a joint filing as required in 35 USC Section 7421:

DOB of each employee;

Type and amount of wages or other payments received by the employee;

Date you receive the wages or other payments; and

The name(s) and address of the business owner.

How many people fill out Form 1095-A each year?

The 2010 Form 1095-A reported 2.1 million 1095-A returns — an increase of about 4.5% from 2009. About 8.5% of the total return, and more than 8 million 1095-A returns in 2010, were received from individuals filing Schedule C, which includes self-employed taxpayers. See the question below about filing Schedule C. About 8.1% of all 1095-A returns were filed by individuals filing Form 1040.

Can you get more information about the number of returns filed?

Information about Form 1095-A is readily available on IRS.gov.

You can get this information by using IRS.gov, going to Forms and Publications, and then using the “Search for Taxes” tool.

You can also contact the IRS by phone at, or by mail at:

Internal Revenue Service

Attn: Forms 1095-A and 1095-B

P.O. Box 122869

Atlanta, GA 3069

Can you get more information about the number of returns filed on a specific tax year?

Information about Form 1095-A and related reports are available in the “Related Publications” section of IRS.gov. You will also find information about how you can use reports on Form 1095-C (with a check, if possible) and Form 1095-C -A (without a check) to calculate the total amount of Social Security and Medicare taxes you owe.

What is the difference between Form 1095-A and Form 1095-B?

Form 1095-A and Form 1095-B together report information about income received and estimated tax paid for each individual for the entire tax year, which is the period from April 15 to June 15. If you don't receive a Form 1095-A or Form1095-B in an April 15 to June 15 period, use Form 1040 to figure your earned income reported in the tax return.

Can you get more information about the number of returns filed?

Information about Form 1095-A, Form 1095-B, and reports are readily available on IRS.gov. You can get this information by using IRS.gov, going to Forms and Publications, and then using the “Search for Taxes” tool.

Is there a due date for Form 1095-A?

Yes, there is a due date. The due date is the first day of the month following the month in which your first year begins.

What is the due date for Form 1095-A?

The due date is the first day of the month following the month in which your first year begins.

What is the due date for Form 1096-C, Employee's Withholding Allowance?

This form is to report income from your employment as of the last day for which all required income tax withholding is calculated and sent to the employer. The due date is the last day of the month following the month in which your first year begins.

What is the due date for Form 1096-C?

The due date is the last day of the month following the month in which your first year begins.

What is the due date for Form 1094?

The due date is the first day of the month following the month in which your first year begins.

What is the due date for Form 1094?

The due date is the first day of the month following the month in which your first year begins.

What is the due date for Form 1106?

The due date is the first day of the month following the month in which your first year begins.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here